process

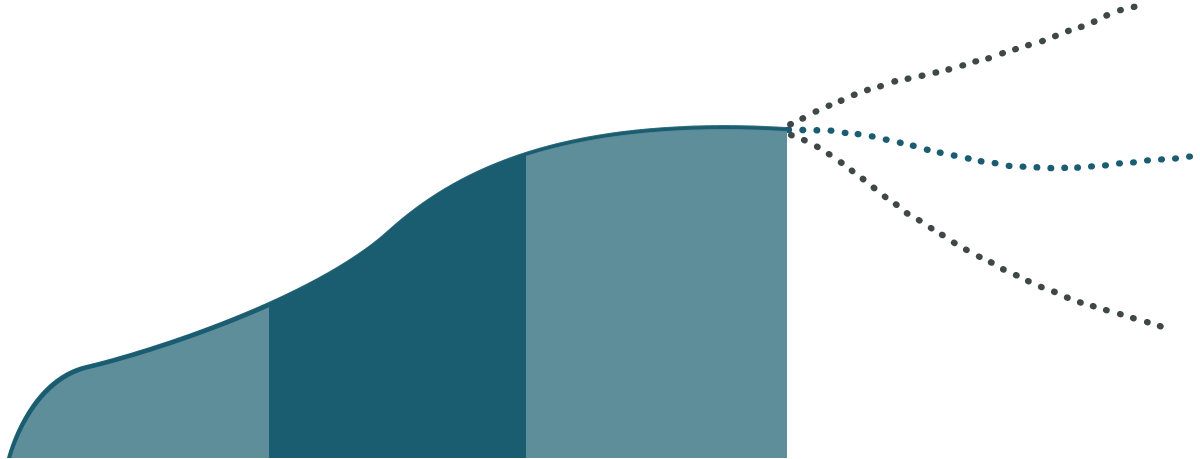

Your Financial Life Cycle

Accumulate

Accumulate

- How much do we need to save?

- Should I invest on a pre-tax or after-tax basis?

- How do I finance my home purchase?

- What is the best method to save for my children's education?

- Do we need life insurance?

- What is proper estate planning?

Grow

Grow

- Are we on track?

- How can we save on taxes?

- Is our portfolio growing at a rate commensurate with our tolerance for risk?

- We want to start our own business, how can you help?

- Is our rental property a good investment?

- Are my assets titled in a way that provides asset preservation and avoids probate?

Spend & Protect

Spend and Protect

- Can I afford the lifestyle I want in retirement?

- Do I need to change my asset allocation now that I’m no longer working?

- What are some tax-efficient distribution strategies?

- Is our estate properly structured and still in alignment with our wishes?

- What happens if inflation sky rockets?

- What happens if the market crashes?

Transfer

Transfer

- What is a donor advised fund?

- What is a qualified charitable distribution and how does it reduce my taxes?

- How do I leave a gift to my favorite charities in a way that benefits us both?

- How do I involve my children in my charitable endeavors?

- How do we protect our wealth from estate taxes?

- What are some advanced estate planning tools

Accumulate

Accumulate

- How much do we need to save?

- Should I invest on a pre-tax or after-tax basis?

- How do I finance my home purchase?

- What is the best method to save for my children's education?

- Do we need life insurance?

- What is proper estate planning?

Grow

Grow

- How much do we need to save?

- Should I invest on a pre-tax or after-tax basis?

- How do I finance my home purchase?

- What is the best method to save for my children's education?

- Do we need life insurance?

- What is proper estate planning?

Spend & Protect

Spend and Protect

- How much do we need to save?

- Should I invest on a pre-tax or after-tax basis?

- How do I finance my home purchase?

- What is the best method to save for my children's education?

- Do we need life insurance?

- What is proper estate planning?

Transfer

Transfer

- How much do we need to save?

- Should I invest on a pre-tax or after-tax basis?

- How do I finance my home purchase?

- What is the best method to save for my children's education?

- Do we need life insurance?

- What is proper estate planning?

HOW DO WE HELP?

-

GATHER

We gather information about your financial situation, review your goals, and address your most pressing needs. During this introductory meeting, we get to know each other better.

-

CREATE

We create a comprehensive financial plan that focuses on your current savings, formulates an investment strategy for your future, and meets your retirement goals.

-

CUSTOMIZE

We customize your portfolio strategy to align with your values, match your risk tolerance, and optimize tax efficiency, while providing detailed recommendations tailored to your specific needs.

-

IMPLEMENT

We provide personalized recommendations tailored to your unique needs and assist in the implementation of these recommendations across various aspects of your life.

-

MONITOR

We continually monitor your investments and financial wellbeing to ensure they are on target with your goals, applying modifications as warranted by life’s changing circumstances.